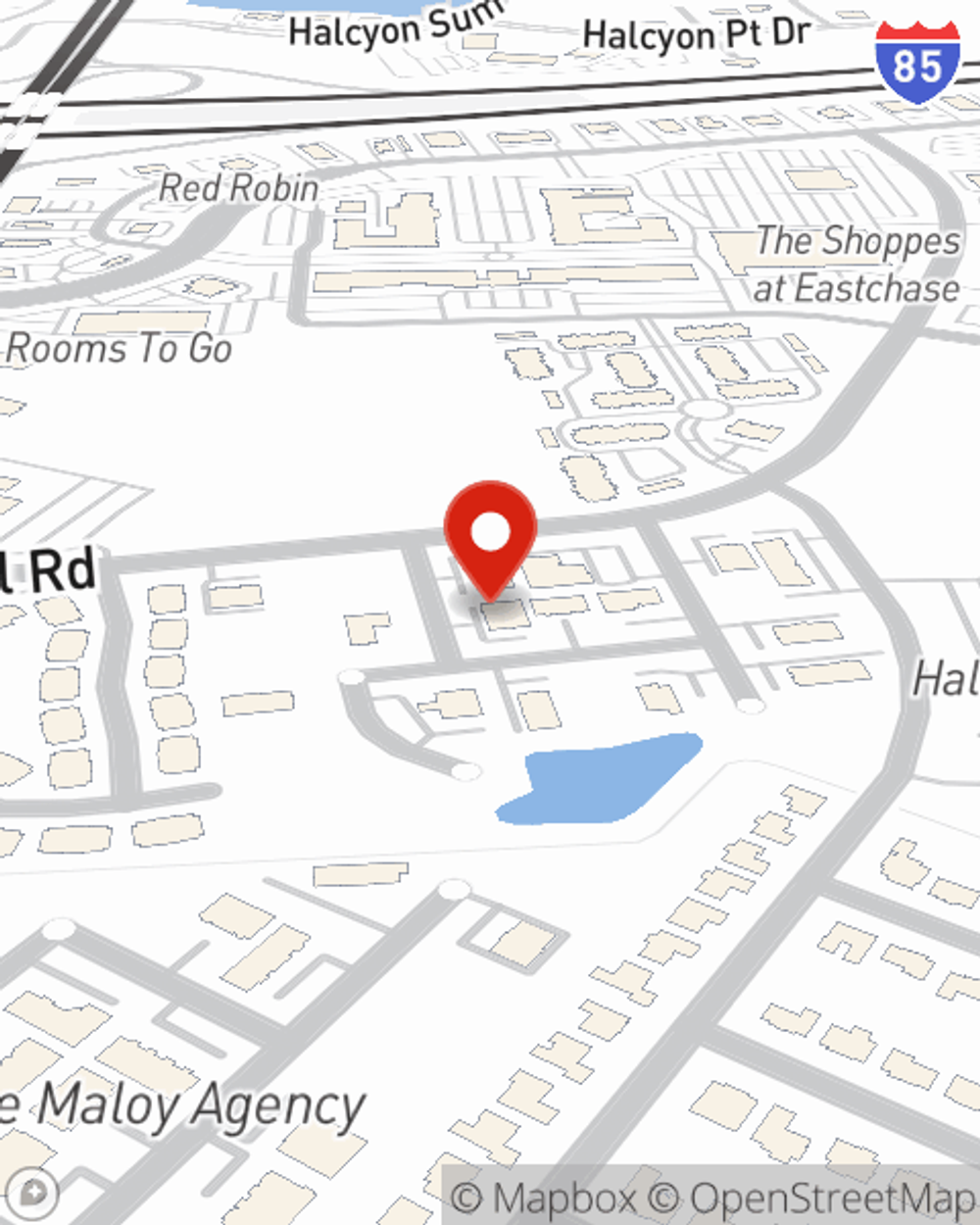

Business Insurance in and around Montgomery

Researching insurance for your business? Look no further than State Farm agent Jessica Majors!

Almost 100 years of helping small businesses

- Montgomery, AL

- Wetumpka, Alabama

- Prattville, Alabama

- Millbrook, AL

- Deatsville, AL

- Pike Road, AL

- Eclectic, AL

- Tallassee, Alabama

- Troy, Alabama

- Pine Level, AL

- Holtville, Alabama

- Autauga County

- Elmore County

- Coosa County

- Macon County

- Bullock County

- Pike County

- Crenshaw County

- Lowndes County

- Butler County

Business Insurance At A Great Price!

Do you feel overwhelmed when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Jessica Majors help you learn about great business insurance.

Researching insurance for your business? Look no further than State Farm agent Jessica Majors!

Almost 100 years of helping small businesses

Insurance Designed For Small Business

Whether you are an insurance agent a pet groomer, or you own a music school, State Farm may cover you. After all, we've been doing it for almost 100 years! State Farm agent Jessica Majors can help you discover coverage that's right for you and your business. Your business policy can cover things such as equipment breakdown and computers.

Contact State Farm agent Jessica Majors today to explore how one of the leaders in small business insurance can safeguard your future here in Montgomery, AL.

Simple Insights®

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Jessica Majors

State Farm® Insurance AgentSimple Insights®

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.